Finding Medicare Supplement Coverage

Finding Medicare Supplement Coverage

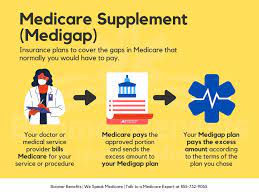

Medicare is a valuable health insurance program for individuals aged 65 and older, as well as for certain younger people with disabilities. However, Medicare coverage alone may not be sufficient to meet all your healthcare needs. That’s where Medicare supplement coverage, also known as Medigap, comes into play. In this article, we will explore the importance of finding the right Medicare supplement coverage and provide you with useful insights to help you make an informed decision.

Why Medicare Supplement Coverage Matters

Medicare provides essential coverage for hospital stays, doctor visits, and other medical services. However, it does not cover all expenses, leaving beneficiaries responsible for co-payments, deductibles, and coinsurance. This is where Medicare supplement coverage can fill the gaps, helping you manage your healthcare costs more effectively.

Understanding Medicare Supplement Plans

Medicare supplement plans are standardized and regulated by the government. These plans are offered by private insurance companies and are designed to work alongside your original Medicare coverage. There are ten standardized plans, each labeled with a letter (A, B, C, D, F, G, K, L, M, and N), and they offer different levels of coverage. It’s essential to understand the details of each plan before making a decision.

Factors to Consider When Choosing Medicare Supplement Coverage

Finding the right Medicare supplement coverage requires careful consideration of various factors. Here are some key points to keep in mind:

1. Coverage Options

Medicare supplement plans offer different levels of coverage. Some plans cover all or most of the out-of-pocket costs not covered by Medicare, while others provide more limited coverage. Evaluate your healthcare needs and choose a plan that best meets your requirements.

2. Premiums and Cost

Consider the monthly premiums for the Medicare supplement plan. Premiums can vary based on the coverage level and insurance provider. Compare different options to find a plan that fits your budget.

3. Provider Networks

Unlike Medicare Advantage plans, Medicare supplement plans do not have specific provider networks. You can visit any healthcare provider that accepts Medicare. This gives you the freedom to choose your doctors and specialists without referrals.

4. Medigap Open Enrollment Period

The best time to enroll in a Medicare supplement plan is during the Medigap Open Enrollment Period. This period begins on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. During this period, you have guaranteed issue rights, which means insurance companies cannot deny you coverage or charge higher premiums based on your health conditions.

5. Prescription Drug Coverage

It’s important to note that Medicare supplement plans do not cover prescription drugs. If you require prescription drug coverage, you will need to enroll in a separate Medicare Part D plan.

6. Additional Benefits

While Medicare supplement plans do not typically offer additional benefits like dental or vision coverage, some plans may provide extra services such as fitness programs or access to telehealth services. Consider if these additional benefits are important to you.

How to Find the Right Medicare Supplement Coverage

Now that you understand the factors to consider, here are some steps to help you find the right Medicare supplement coverage:

Step 1: Research and Compare Plans

Research the available Medicare supplement plans in your area. Compare their coverage, premiums, and reputation of the insurance companies offering them. Websites like Medicare.gov and private insurance company websites can be valuable resources for information.

Step 2: Assess Your Healthcare Needs

Evaluate your current and anticipated healthcare needs. Consider your medical history, the frequency of doctor visits, and any ongoing treatments or conditions. This will help you determine the level of coverage you require.

Step 3: Get Multiple Quotes

Obtain quotes from different insurance providers offering Medicare supplement plans. This will allow you to compare premiums and identify the best options for your budget.

Step 4: Consult with an Expert

Consider consulting with a licensed insurance agent or broker who specializes in Medicare. They can provide personalized guidance based on your specific needs and help you navigate through the available options.

Step 5: Review and Enroll

Carefully review the details of the Medicare supplement plan before enrolling. Ensure it aligns with your coverage needs and budget. Once you have made a decision, follow the enrollment process as guided by the insurance provider.

Conclusion

Finding the right Medicare supplement coverage is essential to ensure comprehensive healthcare coverage and manage out-of-pocket expenses effectively. By considering the coverage options, premiums, provider networks, and other factors mentioned in this article, you can make an informed decision that suits your unique needs. Remember to research, compare, and consult with experts to find the most suitable Medicare supplement plan for you.

FAQs (Frequently Asked Questions)

Q1: Can I purchase a Medicare supplement plan if I am under 65? A1: In most states, Medicare supplement plans are only available to individuals aged 65 and older. However, some states have additional options for people under 65 who qualify for Medicare due to certain disabilities. Check with your state’s insurance department for more information.

Q2: Can I switch Medicare supplement plans at any time? A2: Unlike Medicare Advantage plans, Medicare supplement plans do not have an annual enrollment period. However, you can switch Medicare supplement plans at any time throughout the year. Keep in mind that you may be subject to medical underwriting, which could affect your eligibility and premiums.

Q3: Are Medicare supplement plans standardized in all states? A3: While the basic benefits of each Medicare supplement plan are standardized by the federal government, not all states offer the same plans. Massachusetts, Minnesota, and Wisconsin have their standardized plans, which differ from the standard plans in other states.

Q4: Can I use my Medicare supplement coverage while traveling abroad? A4: Medicare supplement plans do not typically cover healthcare expenses incurred outside of the United States. However, some plans may offer limited coverage for emergency care during foreign travel. It’s essential to review the specific details of your plan or consider additional travel insurance for international trips.

Q5: How do I cancel my Medicare supplement plan? A5: If you decide to cancel your Medicare supplement plan, you can contact your insurance provider directly to initiate the cancellation process. It’s advisable to have a new plan in place before canceling to ensure uninterrupted coverage.